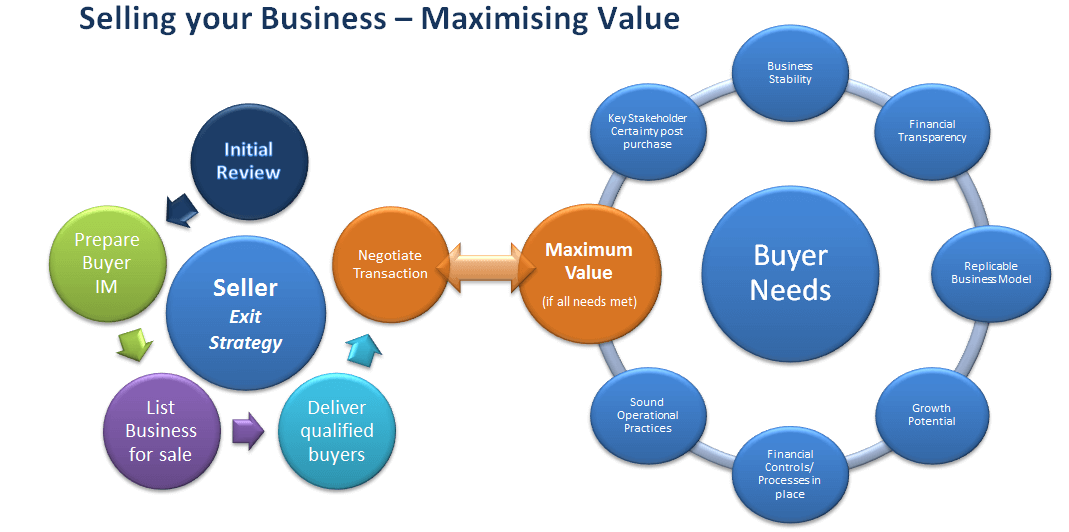

Asset Advisory assists business owners maximise the value of their business through a 5 step process:

1. Initial Review

- Are you selling all or only part of your business

- Is your business “Buyer Ready”

- Review of Taxation & Legal considerations

- Valuation by Certified Practising Valuer (Business)

2. Preparation of Buyer Information Memorandum

3. Business listed for sale by our Specialist Business Broker

4. Deliver qualified buyers

5. Negotiate the transaction through to settlement

Asset Advisory partner with your team of professional advisors or can also provide a qualified team of business partners which can assist with the end goal of structuring and negotiating a successful business sale.

Basics to Maximise Business Value

Financials – Not only should up to date Profit & Loss Statements be prepared and available for a qualified buyer, monthly cashflows should also be provided for the period since the last financial accounts together with detailed budgets of future anticipated cashflows. Providing this information reduces the uncertainty in a buyers mind and reduces the period of time taken during the due dilligence phase.

Systems – It is imperative that the systems and procedures are formalised and recorded to enable a smooth transition. “SOPS” or Standard Operating Procedures & Systems describe the techniques and other crucial systems to give the buyer confidence that the business can continue to be viable without the existing operator.

Relationships – It is important that key business relationships are formalised into binding agreements that are transferable. These relationships vary according to each business but may include supply agreements, contracts & intellectual property rights.

Business Location – Should the location of the business be an important operating factor, it is important to have a secure lease structure in place prior to the business being offered to the market. Typically, a reasonable lease rental and favourable annual reviews are sought after attributes. This factor can impact substantially on the value of the business from a buyers perspective.